Total 0 ratings

Overview

Covalue is a best Financial Advisor in Ram Niwas, Madhu Park, Khar - West, Mumbai - 400 052, India.. We have 30 years experience in analytics, business, valuation, field. If you need any help please call us our mobile number 08144514842 and you can send an email our support analyticscovalue@proton.me. We are best Financial Advisor in Columbia, Bogota.

Are you a business owner?

Claim & grow your business with My Fists the World Longer Local Business Directory. It's totally free

Services

About the business of Covalue

Unlock Business Valuation: Learn 10 Essential Methods and Formulas to Determine the Value of a Company."

Business valuation is the process of determining the current value or worth of a business. There are various factors that are taken into account when determining the value of a business, including financial and non-financial information. The valuation process is important for a variety of reasons, including determining the selling price of a business, assessing the value of a business for tax purposes, and evaluating investment opportunities.

There are several methods used to determine the value of a business, and each method has its own advantages and disadvantages. Some of the most commonly used methods for business valuation include Discounted Cash Flow (DCF), Discounted Future Earnings (DFE), Dividend Discount Model (DDM), Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization (EV/EBITDA), Price to Earnings (P/E), Price to Sales (P/S), Book Value, Price to Book, Liquidation Value, and Market Capitalization.

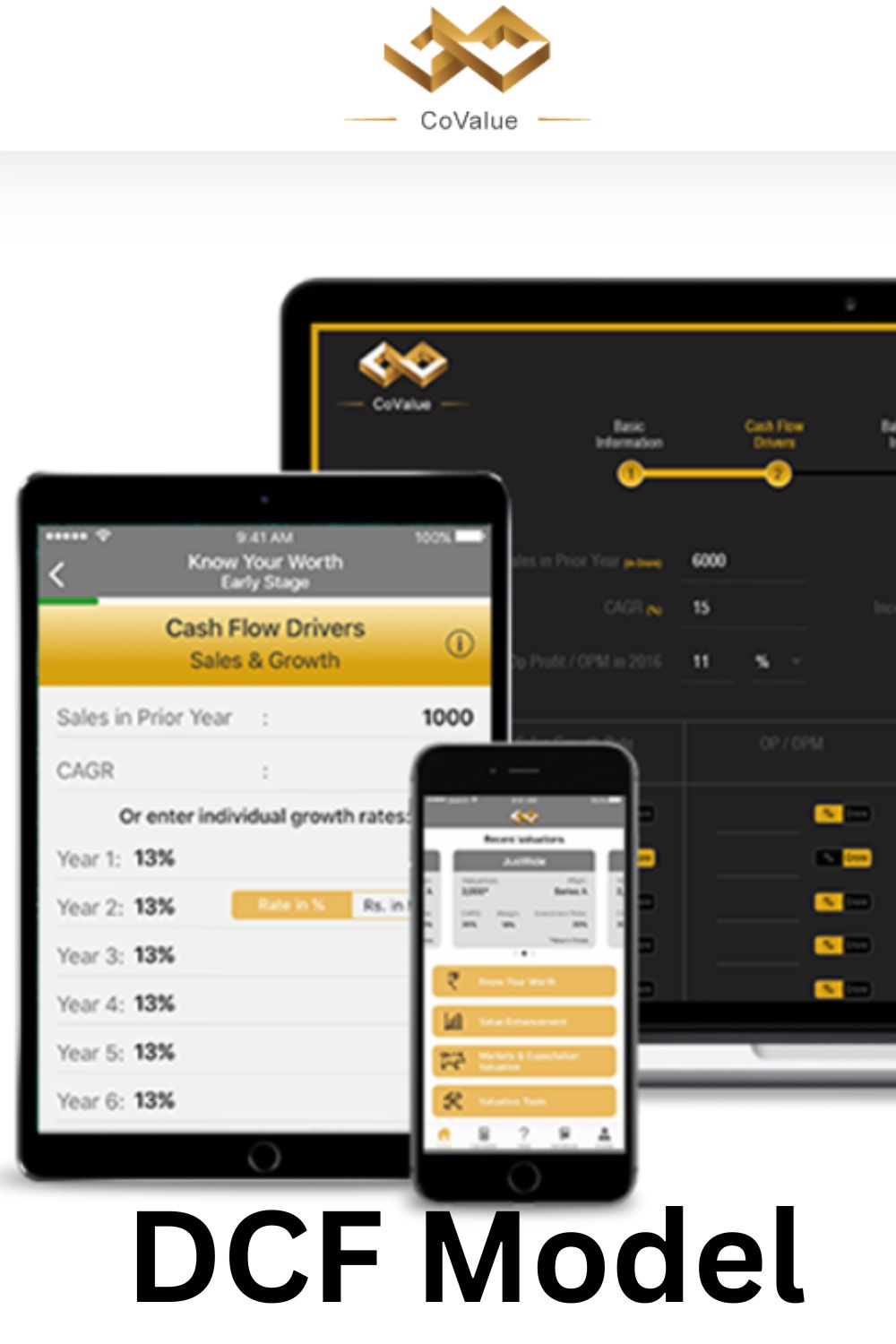

Discounted Cash Flow (DCF) Model

The Discounted Cash Flow (DCF) method is a widely used and most accepted business valuation method in finance and investment. It involves forecasting future cash flows of a business and discounting them back to their present value using an appropriate discount rate. The cash flows used in the model include both the expected cash flows during the forecast period and the expected cash flows beyond that period, commonly referred to as the terminal value. The terminal value represents the estimated value of the business beyond the forecast period and is typically calculated using a perpetuity formula or a multiple of the final year's cash flow. However, the terminal value is often a significant portion of the total value in the DCF model and can be subject to significant estimation uncertainty.

The DCF model is considered suitable for valuing most types of businesses and companies as a going concern. However, it may not be appropriate for valuing companies in certain industries like banking, finance, and insurance, which have unique characteristics.

The formulae for computing is the value is as follows:

DCF = CF1/(1+r)^1 + CF2/(1+r)^2 + CF3/(1+r)^3 + ... + CFn/(1+r)^n

where: CF1, CF2, CF3, ..., CFn are the cash flows in years 1, 2, 3, ..., n respectively

r is the discount rate used to discount the cash flows

n is the last year of the forecast period.

The formula represents the present value of all future cash flows discounted to their present value at a rate of r. The sum of these present values represents the total present value of the future cash flows

Discounted Future Earnings

The Discounted Future Earnings (DFE) method estimates the present value of future earnings generated by the business. It is similar to DCF, but instead of focusing on cash flows, it focuses on earnings. This method is commonly used when valuing banking, finance, and insurance companies, and it can also be used to value indices based on EPS growth.

However, the DFE business valuation method has limitations, as it does ignores financial metrics such as future capital and working capital investments.

Dividend Discount Model

The Dividend Discount Model (DDM) is a commonly used approach for valuing companies, especially those that pay dividends. It is based on the principle that the intrinsic value of a company is determined by the present value of its future dividend payouts. The DDM assumes that the company will continue to pay dividends into the future, and that the dividends will grow at a steady rate.

The formula for the DDM is P = D / (r - g),

where P is the intrinsic value or fair value of the company's stock,

D is the current dividend per share,

r is the required rate of return, also known as the investor's expected rate of return, and

g is the expected growth rate of the dividend.

The DDM method of business valuation has some limitations, such as assuming a constant growth rate that may not reflect actual market conditions. As such, it is best used as one tool among many when evaluating the value of a company.

EV to EBITDA

The Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization (EV/EBITDA) method of business valuation is a financial metric that helps investors and analysts determine the value of a company. EV represents the total value of a company's operations, including both its equity and debt. It is calculated by adding the market value of the company's equity to its debt, and then subtracting its cash and cash equivalents. Once the enterprise value is determined, it is divided by the company's EBITDA, which is a measure of a company's operating income.

This gives you the EV/EBITDA ratio, which is a multiple that reflects how much investors are willing to pay for each dollar of a company's EBITDA.

However, this business valuation method has limitations, as it does ignores financial metrics such as future earnings and future capital and working capital investments

One of the advantages of the EV to EBITDA method of valuation is that it allows investors to compare companies across different industries and sectors.

Price Earnings (P/E)

This business valuation method is used to calculate the current market price of a share of stock by dividing the stock's current market price by the company's earnings per share (EPS) over the past 12 months. A high P/E ratio indicates that investors are willing to pay more for a company's earnings. However, the P/E method has limitations, as it does not account for changes in a company's future earnings, ignores financial metrics such as debt levels, capital and working capital investments.

Price to Sales

Price to Sales (P/S): This business valuation method compares a company's market capitalization to its annual revenue. The P/S ratio provides insights into a company's growth potential and is useful for companies that are not yet profitable or operate in volatile and competitive markets.

Book Value

Book Value: Book value assesses a company's worth based on its financial statements, particularly its balance sheet. Book value is calculated by subtracting the company's total liabilities from its total assets. However, book value is just one of many methods of business valuation and should be used in conjunction with other methods to gain a comprehensive understanding of a company's value.

Price to Book Value

Price to Book Value (P/B) ratio compares a company's market price per share to its book value per share. This ratio can indicate whether a stock is undervalued or overvalued. However, the P/B ratio has limitations, as it does not take into account a company's future earnings potential, capital and working capital investments or intangible assets such as brand value or intellectual property. The Price to book Value method of business valuation is commonly used to value banking and finance companies.

Liquidation Value

Liquidation value estimates the value of a company's assets if it were to be sold off in pieces and its liabilities paid off. It is most useful for investors who are primarily concerned with the value of the company's assets rather than its potential future earnings. However, liquidation value as a business valuation method may not accurately reflect the true value of a company in a going concern scenario, where the company is expected to continue operating and generating profits.

Market Capitalization

This business valuation method is used to determine a company's valuation by multiplying the number of outstanding shares of a publicly traded company by its current market price per share.

In conclusion, when valuing a business or company, it is important to consider multiple business valuation methods to arrive at a comprehensive estimate of its value. Each business valuation method has its own strengths and weaknesses, and investors should select the appropriate method(s) based on the specific circumstances of the company being evaluated.

Covalue Found On : 1994

Domain Registration Date : 16-Jun,1994

Age of Covalue

Anniversary

-

00

days

-

00

hours

-

00

minutes

-

00

seconds

Covalue Contact Details :

Today : Close

Mon - 10:00 AM to 05:00 PM

Tue - Close

Wed - Close

Thu - Close

Fir - Close

Sat - Close

Sun - Close

Covalue Address

Mail : analyticscovalue@proton.me

Phone Number : 08144514842

Country Name : United States

State Name : Columbia

City Name : Bogota

Zip-code : 400 052

Address : Ram Niwas, Madhu Park, Khar - West, Mumbai - 400 052, India.

Verified Info :

Payment accept :

Paypal

Frequently Asked Questions (FAQ) :

Related Business

High Quality Free Guest Post Site List (Instant Live Your Article)

[Coming Soon]

Premium Entry Listing for Business

You will be placed in front of speacific / all category listing page on MyFists

Better Ranking & Response from Visitor

You can terget selected category visitor & many more